As we’re sure you’re aware, there’s currently a cost-of-living crisis taking place across Carlisle, Cumbria, and in fact, the entire United Kingdom.As a result, people from Carlisle to Dover are trying to make the most of the money they have now, rather than thinking about savings, investments, and pensions of the future.

And while this is understandable as a knee-jerk reaction to economic uncertainty, disregarding your future is one of the worst financial moves you can make, especially when it comes to planning for your pension.

So, in today’s article, we’ll discuss why pensions are so important, and offer some answers to pension questions we get asked all the time.

Let’s jump in with one of the most popular pension-based questions.

How often should I keep track of my pensions?

It’s easy to forget about your pensions, especially if you’ve moved jobs over the years and have lots of different pots you’ve paid into. That’s why it’s understandable if you don’t check on your pensions as much as you’d like, but as a rule of thumb, you want to be checking them at least once a year.

Of course, it’s better to check on them more than this, but doing so once a year will give you an idea of what they’re worth and how they’re performing. Most importantly, it’ll give you a strong indication of whether or not you’re likely to meet your long-term financial goals.

What happens to my pension money and benefits when I leave my employer?

In short, you keep your pension if you leave your employer and get a new job. Just because you’ve left the job, it doesn’t mean you lose the benefits of your pension, even if you lose track of where that pension is.

What if I lose track of my pensions?

First of all… Don’t worry! We can help you track pensions from all your previous jobs, so you don’t lose out on the money you’ve put into your pension investments.

We do this through the pension tracing service we provide to clients from Carlisle, Cumbria, and anywhere in the UK, so you can keep track of your pensions and make sure they’re performing for you.

Get in touch to discuss how we can help track your pensions.

How much do I need to retire?

As is the case with most questions about your personal finances, there isn’t a one-size-fits-all answer for this one. Everybody is different and it depends on your circumstances, but as of today, the state pension at the age of 66 is £185.15 per week.

This is barely enough to get by in the current economic climate, and is certainly not enough for you to live comfortably and spend money on things you enjoy. We’re not talking about yacht parties and trips to Monaco; we’re talking about having a social life of some kind, seeing friends and family, visiting new places, and dining out.

That’s why it’s important to have a strong private pension to add to your state-funded pension, and why it’s important to choose a financial adviser to help you grow your pension funds properly for when the time comes.

At Stan Sherlock Associates, we serve the Carlisle and Cumbria areas but offer advice across Central Scotland, The North East of England, and further afield. We offer bespoke advice regarding your pension, so get in touch to find out how we can help.

Can I take my pension fund all at once?

If you hit your pension scheme’s retirement age, then you can take your entire pension in one go. However, just because you can, doesn’t make it a good idea.

This is because 25% of what you take will be tax-free, but you’ll more than likely have to pay income tax on the remaining 75%. This is an astonishing figure and could put a huge dent into what you’ve earned over the years.

There are all kinds of pitfalls when it comes to withdrawing your pension, so get in touch with Stan Sherlock Associates to avoid them and make sure you get the most out of your pension pots.

What are the advantages of combining my pensions?

Combining or consolidating your pensions is a brilliant method of unlocking growth in your investments, and can mean:

- Less work – One pension pot is better than lots, and a single location for your pension investments makes it much easier to keep track of and manage.

- Save money – Since you’re not paying lots of different providers’ management fees, you could save money by combining your pension pots.

- Better investment opportunities – Consolidated pensions often have better investment opportunities than older schemes. This means you can gain more income and benefits from them as opposed to outdated plans.

To find out about the many benefits of combining your pensions, whether you’re in Carlisle, Cumbria, or anywhere else in the UK, get in touch with our pension planning experts today.

What’s the difference between defined benefits & defined contribution pensions?

Simply put, defined benefit schemes are the traditional kind of pension. You know what your scheme will pay you when you retire, and it’s generally based on how long you’ve worked there and the salary you received.

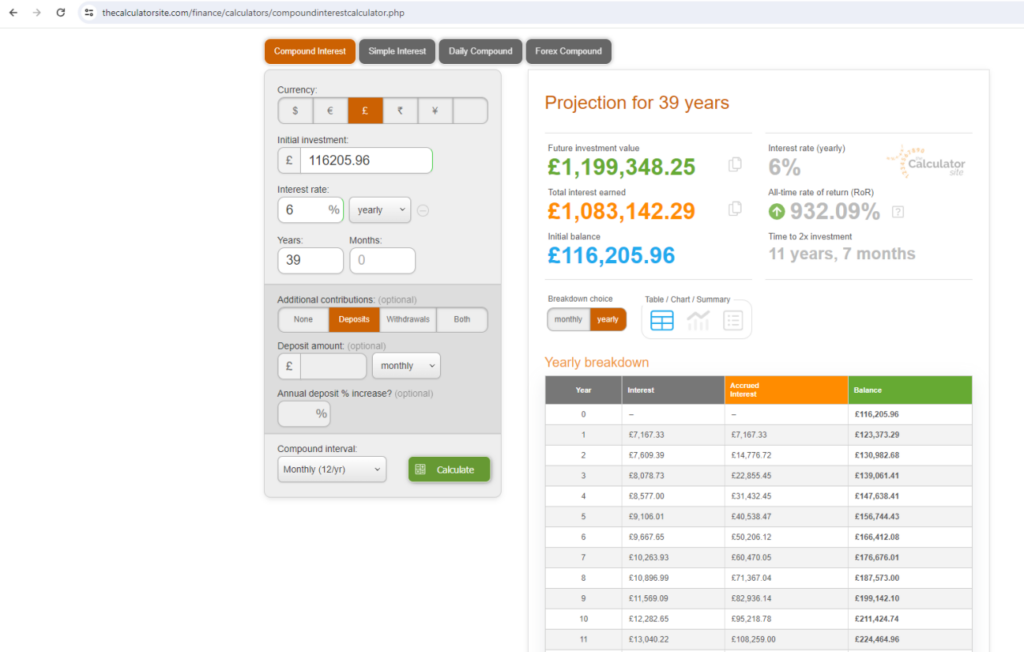

Defined contributions are becoming more popular, mainly because they cost your employer less. The value at retirement depends on how much you pay in, and how well that grows over the years.

As these types of pensions are based on performance, you need to make sure you have a strong strategy in place for your pension investments. Which is why it’s a good idea to take advice from an expert.

Can I collect my pension and still work?

The short answer to this one is yes! You can access private pensions from the age of 55 onwards, and still work alongside them if you like. This also applies to the state pension once you’re eligible to collect it.

Get in touch with Stan Sherlock Associates

Based in Carlisle, Cumbria, our experts have years of experience working with clients across Cumbria and beyond, helping with pension planning and financial advice.

Our expert team provides support and guidance in all aspects of pensions, which include:

- Setting up your pensions

- Finding your lost pensions

- Pension consolidation

- Pensions freedoms advice

- IHT planning

- Passing on your wealth

Get in touch to find out how we can help you prepare your retirement with the perfect pension strategy.

The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen.

Approved by the Openwork Partnership on 26/9/2023

stansherlocstg

on

March 20, 2024